Analytical Instrumentation

How do Elections Affect Oil?

Nov 15 2016

Regardless of whether its Trump versus Clinton or JFK versus Nixon, there’s no escaping the fact that elections tend to trigger oil price slides. In the weeks following Trump’s shocking victory, economists are warning investors to brace for a presidential price plummet, which is expected to send oil prices on a downward trend. The advice comes from analysts at S&P Global Platts, who maintain that oil prices typically fall during the 90-day period following US Election Day.

The good news is that while oil prices are set to fall, the S&P Global Platts report also identified a trend that sees oil prices rebound around the time of the presidential inauguration. In this case, it will be Trump heading to the White House on January 20, 2017.

From Bill to Barack

The trend was at its most recognisable in 1992, when Brent crude fell from a high of $19.46 per barrel just after Bill Clinton was elected, to a low of $16.56 per barrel on his January 20 inauguration day in 1993. This represents a drop of 14.9%, though in less than two weeks prices recovered by 12.5%.

The same pattern emerged in 2000, when George W. Bush was elected. Between November 15 and Dec 20 oil prices fell by 37.3% to a dismal $21.56 per barrel. Though by February 2001 the oil market had not only recovered, but increased by 37.7% to a high of $29.69 per barrel.

“Adjusted for inflation, they were at all-time lows in February 1999. Prices thereafter started to climb, leading to the long-term bull market before being interrupted by the fiscal crisis and ending with the shale boom,” explains S&P Global Platts in its analysis report.

After winning the White House campaign in 2008, Barack Obama’s presidency kicked off with $63.77 per barrel prices on Election Day. Though oil quickly embarked on a downhill trend, and plummeted to a low of $33.66 per barrel in the midst of the global economic crisis.

Are incumbents the exception to the rule?

Interestingly, the market reaction was different in 2012, when President Obama stepped up for a second term. Compared to other presidential elections oil prices fared surprisingly well, which led S&P Global Platts analysts to conclude that the market experiences less post-Election Day volatility if the incumbent candidate wins.

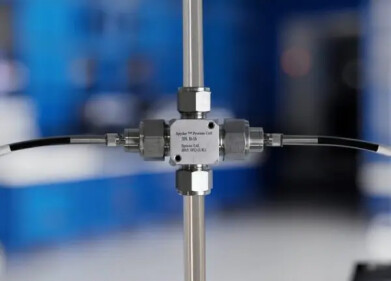

Election or no election, oil producers are continually on the search for new ways to improve efficiency. ‘Precision + lower operation cost + minimum initial investment = CID 510’ spotlights the latest Constant Volume Combustion Chamber (CVCC) technology being used to analyse end products, and substitute the CFR Engine, which is both inefficient and expensive.

Digital Edition

PIN 25.5 Oct/Nov 2024

November 2024

Analytical Instrumentation - Picturing Viscosity – How Can a Viscometer or a Rheometer Benefit You? - Sustainable Grease Formulations: Evaluating Key Performance Parameters and Testing Method...

View all digital editions

Events

Dec 03 2024 Dusseldorf, Germany

Dec 08 2024 Anaheim, CA, USA

Turkey & Black Sea Oil and Gas

Dec 11 2024 Istanbul, Turkey

Dec 19 2024 Aurangabad, India

Jan 20 2025 San Diego, CA, USA