Analytical Instrumentation

How Are Deep-Water Oil Rigs Changing?

Apr 27 2017

Like any industry, the oil and gas landscape is continually evolving. And in the wake of the US shale boom, change is more prominent than ever. According to experts, the shale revolution has transformed the way deep-water oil exploration projects are carried out. Instead of channelling huge amounts of cash into deep-water projects, producers are actively scaling down production.

"It's not so much innovation, it's more a change in mind-set," comments Angus Rodger, an upstream oil and gas research director for Wood Mackenzie.

Slashing costs, boosting ROI

Basically, producers are slashing costs by making deep-water projects smaller and less productive. Barrel counts drop, but so do breakeven costs. Overall, this boosts ROI and ensures that producers turn a profit.

Projects in the Gulf of Mexico are fronting the movement, with the average breakeven cost set to drop to below US$50 per barrel. This represents a significant drop from the former US$70 price tag. If the new breakeven price stabilises, it would put crude on par with competitively priced shale oil, which currently sells for around US$50 a barrel. According to a recent report from US consultancy Rystad Energy, the current break-even price for US shale is around US$35 a barrel. Crude’s not quite as cheap to produce, but a US$50 breakeven cost definitely levels out the playing field.

Deep-water projects on the rise in 2017

Armed with a new attitude, experts are now predicting that deep-water projects could undergo a revival in 2017. Three have already been approved, with another five in the works. If all eight go ahead, this would see the number of projects equal the combined total for 2015 and 2016.

"The majors are showing signs they are looking at this resource class again," comments Rodger, referring to BP’s recent M&A transactions in Egypt and Senegal, as well as Statoil and Total's deals in Brazil.

Domination from the big guns

Unsurprisingly, he also predicts that due to long project timelines and large investment capital requirements, deep-water exploration will remain dominated by established oil and gas giants. Meanwhile, small and medium sized players will channel cash into lower cost shale.

"Deep-water remains a big boys' game, it's not for everyone," says Rodger.

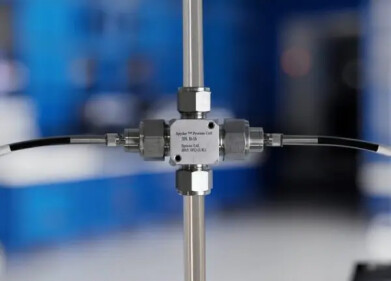

Given the colossal cost of deep-water projects, producers are constantly on the lookout for ways to cut costs. ‘OptiFuel: A Game-Changer in Rapid Fuel Analysis Using Cutting-Edge FT-IR technology’ spotlights the latest next-generation technology from PAC. With its industry leading warranty, proprietary design, absence of moving parts and extreme ease-of-use, OptiFuel actively analyses refined fuels quickly, and efficiently.

Digital Edition

PIN 25.5 Oct/Nov 2024

November 2024

Analytical Instrumentation - Picturing Viscosity – How Can a Viscometer or a Rheometer Benefit You? - Sustainable Grease Formulations: Evaluating Key Performance Parameters and Testing Method...

View all digital editions

Events

Dec 03 2024 Dusseldorf, Germany

Dec 08 2024 Anaheim, CA, USA

Turkey & Black Sea Oil and Gas

Dec 11 2024 Istanbul, Turkey

Dec 19 2024 Aurangabad, India

Jan 20 2025 San Diego, CA, USA