Oil analysis

How Has Oil Dropped Below Zero?

Apr 23 2020

On Monday, for the first time in history, prices for US benchmark oil West Texas Intermediate (WTI) slipped into negative territory. Prices tumbled to US$40 a barrel below zero, a trend that sent shockwaves across the global energy industry.

So how did WTI, one of the most valuable and in demand resources in the world, hit such a low? The collapse was spurred by a sharp fall in demand caused by the COVID-19 pandemic. The outbreak, which has infected more than 2.6 million people around the world, forced demand down to levels not seen in 25 years. Major economies around the world shut down, including factories across China. There have also been shattering disruptions for the air travel sector, with border closures forcing airlines to cancel domestic and international routes.

Russia and Saudi Arabia price war flattens prices

Alongside the global demand slump, the market was also flooded with oil from Russia and Saudi Arabia, who were engaged in a price war for much of March. Despite big declines in demand and prices, American oil producers continued to pump WTI crude. This quickly led to a significant supply and demand imbalance that depleted Stateside storage capacity. Eventually, producers were churning out oil faster than it could be purchased or consumed. With storage facilities full, this forced producers to pay buyers to take oil offsite.

At its lowest point, producers were paying buyers around US$40 to 'purchase' oil. While it seems like an irresistible deal, buyers are responsible for transporting oil offsite and arranging storage, which can be expensive. They also need to be confident oil prices will recover enough to cover the expenses and turn a profit.

Brent crude also risks slipping into negative territory

So far, the United States is the only nation that's faced negative oil prices. The country produces 10 million barrels per day which quickly depleted storage capacity. In comparison, prices in the UK are still above zero thanks to readily available storage and lower transport costs. Brent crude, the international oil benchmark, recently dropped to $US16.59 a barrel, with analysts warning that if measures aren't taken it could also slip into negative territory. Where WTI is reliant on pipelines, Brent crude is reliant on ships as a major form of transport and storage. Currently, more than 100 million barrels of Brent are being held in floating storage. If capacity starts to run low, prices could be pushed further down, potentially into negative figures.

Want to know more about the latest oil industry landscape? 'Recent Developments in the Crude Oil Market as it Relates to the Asian Oil Industry' explores the impact the COVID-19 pandemic has had on Asian markets.

Digital Edition

PIN 26.1 Feb/Mar 2025

March 2025

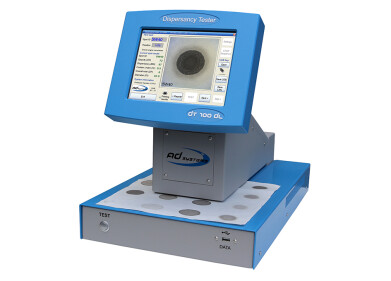

Analytical Instrumentation - Elemental Analysis for Quality and Process Control at Refineries, for Lubricants and Wear Metals in Engine Oils - Synthetic Lubricants: New Developments - Scaling...

View all digital editions

Events

Apr 08 2025 Birmingham, UK

Apr 08 2025 Kielce, Poland

Apr 08 2025 Ravenna, Italy

Apr 08 2025 Southampton, UK

Apr 08 2025 London, UK

.jpg)