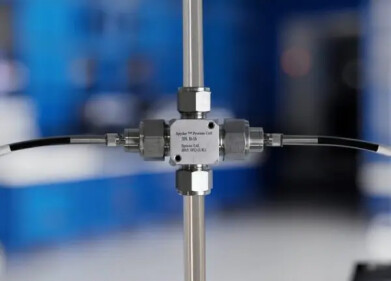

Analytical Instrumentation

What is the Inventories Spread?

Jan 03 2018

From surpluses to shortages, oil stockpiles play a pivotal role in influencing the market. Every week the Energy Information Administration (EIA) releases a Crude Oil Inventories report that measures the seven-day change in the commercial crude inventories oil held by US firms. This has a direct impact on the market value of petroleum products, with the power to send prices soaring or plummeting.

Bearish versus bullish

The level of inventories influences the price of petroleum products, which can have an knock-on impact on inflation. If crude inventories surpass expectations the report implies weaker demand and can trigger a bearish trend for crude prices. The same scenario arises if inventories decline by less than expected. If crude inventories don't meet expectations it indicates high demand and creates a bullish market. This can also materialise when a decline in inventories is more than expected.

For example, in the week ending November 17 2017 US commercial crude oil inventories fell by 1.9 million barrels. This was 0.5 million barrels more than the expected fall. In the same week US crude oil stockpiles were estimated at 457.1 million barrels, which prompted crude oil prices to rise by 2.1%.

The sway of five-year averages

As well as short term fluctuations five-year averages also influence the market. This is known as the “inventories spread” and measures the difference between US commercial crude oil inventories and their five-year performance. If the spread increases it can trigger a fall in oil prices, and vice versa.

In 2018 market analysts are predicting a 2.5 million barrel drop in US commercial crude oil stockpiles. This is despite the fact that the American Petroleum Institute has reported an oil inventory rise of around 1.8 million barrels. If the EIA reports a similar prediction it would surpass the 0.6-million-barrel rise and maintain consistency of the inventories spread.

The 2018 outlook

As a result, a possible rise in the inventories spread could prevent oil prices from hitting a new high in 2018. Meanwhile, International Energy Agency Chief Fatih Birol maintains that the expansion in the premium and the rise in oil prices suggests a bullish scenario. He predicts that if global oil demand rises in line with OPEC’s current production cut that will continue to span beyond March 2018, demand could soon overtake the supply.

With oil surpluses a constant risk, refiners place a big focus on maximising efficiency. Championing lower cost, robust HRMS instrumentation, 'Selective Ionisation and Affordable High Resolution Mass Spectrometry' explores how the new method is revolutionising molecular characterisation in the petroleum and petrochemical industries.

Digital Edition

PIN 25.5 Oct/Nov 2024

November 2024

Analytical Instrumentation - Picturing Viscosity – How Can a Viscometer or a Rheometer Benefit You? - Sustainable Grease Formulations: Evaluating Key Performance Parameters and Testing Method...

View all digital editions

Events

Dec 03 2024 Dusseldorf, Germany

Dec 08 2024 Anaheim, CA, USA

Turkey & Black Sea Oil and Gas

Dec 11 2024 Istanbul, Turkey

Dec 19 2024 Aurangabad, India

Jan 20 2025 San Diego, CA, USA

.jpg)