Analytical Instrumentation

How Has the US-China Trade Dispute Affected Oil Pipelines?

Apr 16 2018

For years, America and China, two of the world's biggest economies, have been engaged in trade tensions. In early 2018 the dispute took a turn for the worse, with the World Trade Organisation warning that "tit-for-tat tariffs" could soon trigger higher levies on hundreds of billions of dollars in bilateral trade and investment between the two economic superpowers. Some experts even warn that the economy could be on the brink of a US-China trade war.

Beijing turns up the heat

While Trump has become notorious for his brash, hard-handed approaches, the latest developments suggest that Beijing isn't afraid to turn up the heat on the controversial US president. So far, it's slapped tariffs on almost 130 US products, worth a collective US$3 billion. This includes a 15% tax on steel and alloy which is primarily manufactured along the Texas Gulf Coast.

The taxes were a retaliatory move triggered by similar tariffs the US imposed on Chinese steel and aluminium. They saw the market hit with a 25% tariff on steel imports and 10% on aluminium, which Trump marketed as a strategy to "address unfair global practices" and safeguard American industries. With the US importing around three-quarters of the steel used in its oil and gas pipeline projects, China could see a big impact on its bottom lines.

WTO warns of “domino effect”

With the trade dispute between the United States and China rapidly escalating, investors are worried that the turbulent economic climate could drag down America's steel and aluminium industries. Not only will the tariffs affect steel and aluminium manufacturers, but if the trade war intensifies it could see China target broader energy related machinery classes

Roberto Azevedo, head of the World Trade Organisation has warned that the simmering competition between the US and China could trigger a “domino effect” that could ultimately slow down markets and impact both the American, and the global economy.

“A cycle of retaliation is the last thing the world economy needs,” stresses Azevedo. Christine Lagarde, managing director of the International Monetary Fund (IMF) agrees, warning that “darker clouds” are closing in over the world economy. “Governments need to steer clear of protectionism in all its forms,” she urged in a recent speech given in Hong Kong. “History shows that import restrictions hurt everyone.”

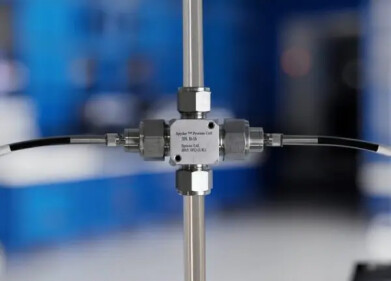

From metering pumps to underground tubing, metals like steel and aluminium literally bolster the global oil and gas industry, as well as other markets like food processing and manufacturing. Introducing the latest durable and low maintenance technology from Bühler, 'Bellows Pumps as the Foundation for Process and Emissions Analysis Sending Sample Gas Well on its Way' spotlights one of the industry's top-tier technology groups.

Digital Edition

PIN 25.5 Oct/Nov 2024

November 2024

Analytical Instrumentation - Picturing Viscosity – How Can a Viscometer or a Rheometer Benefit You? - Sustainable Grease Formulations: Evaluating Key Performance Parameters and Testing Method...

View all digital editions

Events

Dec 03 2024 Dusseldorf, Germany

Dec 08 2024 Anaheim, CA, USA

Turkey & Black Sea Oil and Gas

Dec 11 2024 Istanbul, Turkey

Dec 19 2024 Aurangabad, India

Jan 20 2025 San Diego, CA, USA